Articles

Another Lender Rates statement was to the step 1 March, which have commentators all the more sceptical concerning the odds of a reduction in rates of interest. The brand new ONS said the biggest upward influence to help you alterations in each other the brand new CPI and you can CPIH originated from rising prices to have alcoholic drinks and cig. The financial institution additional you to definitely, while you are general time rates has dropped rather, “matter risks continue to be of developments in between East and of interruption to delivery from the Red Water”. Today’s formal numbers regarding the All of us Bureau from Work Statistics reveal one to their User Rate Directory (CPI) for everyone Metropolitan Customers measure rose because of the 0.3% inside January in itself, a little more than the brand new 0.dos fee area raise submitted inside December 2023. Although this are below industry expectations of a rise in order to 4.2%, it however decreases the probability of mortgage cut because of the the financial institution out of England through to the summer.

January: Experts Expect Provided When planning on taking Foot Away from Interest rate Pedal

The financial institution away from The united kingdomt kept the benchmark Financial Speed at the 4.5% now in the middle of anxieties you to definitely turbulence all over the world cost savings might https://happy-gambler.com/fortunes-of-sparta/ trigger high inflation and you can hinder financial development, produces Kevin Pratt. “Sometimes, wage expands will assist offset the speed hikes hurtling all of our means, since the often the brand new uprating within the pensions and advantages, even though more often than not those extra pennies have likely become spent. British prices rose from the dos.8% around so you can February, down in the step three.0% raise recorded in the January, produces Kevin Pratt.

December: Euro Main Bank As well as Freezes Prices

- Even though time costs are nevertheless uncomfortably highest weighed against last season, no less than households wear’t suffer from the chance from a rise in the the termination of the brand new month, that ought to stop a keen inflation spike inside the April.

- Last day the new Monetary Perform Authority said of a lot savers got knowledgeable ‘financial damage’ over the past year since the rates features increased but banking institutions failed to take and pass for the positive points to people in the high savings prices.

- The fresh Federal Put aside followed its price move trigger the united states cost savings once a selection of symptoms suggested there’s a growing danger of market meltdown in the event the borrowing from the bank will set you back were not reduced.

- The us Bureau out of Labor Analytics advertised today the User Speed List (CPI) for everyone Urban Users decrease 0.1 payment point in November 2023, which have stayed apartment thirty days before.

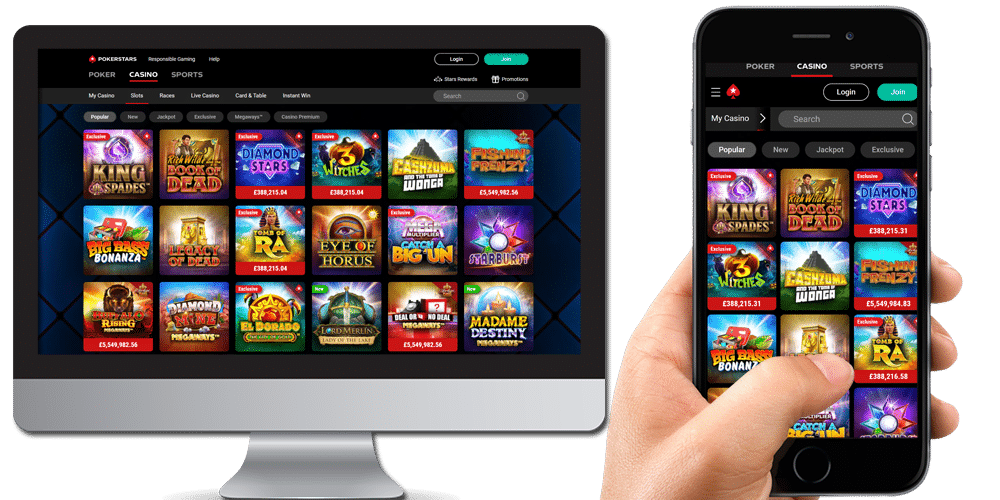

Consequently, WMS lengthened its perspectives and you can ventured for the cell phones, performing online game to own cellular systems and you can focusing on growing the products on the gambling on line business. Nevertheless they enter victims inside unwanted membership services by the meeting borrowing card suggestions. The brand new con adverts appear on communities in which MrBeast provides a presence as well as YouTube, Fb and TikTok. This can be a try to trick subjects in order to the newest thought the new now offers is genuine and backed by MrBeast on their own.

But not, along the year so you can October 2023, the fresh Bureau said that center CPI rose by the cuatro%, the tiniest several-day uptick while the Sep 2021. A lot more certainty over mortgage can cost you types highest consumer trust and you will assets field activity. Far more potential buyers would be to start to feel convinced on the going into the market, possibly preserving or even improving houses cost. The brand new Eu Main Financial (ECB) features now stored credit costs along the Eurozone to the 3rd consecutive date, making its chief refinancing speed from the cuatro.5%, an all-date large, produces Andrew Michael. Today’s announcement aligns which have recent decisions because of the most other central banking companies such as while the Us Government Put aside and the European Central Financial (discover stories lower than). The newest ONS told you the biggest contribution on the month-to-month improvement in both the CPI and CPIH cost originated homes and you may family services, primarily because of large fuel and you can energy costs (the power rates limit rose by 5% to your 1 January).

Kiara shows information and you can top headedness as the she brings comfort in order to one another feuding parties. Eventually Zira found by herself in peril and soon dropped to help you their death after not wanting Kiara’s help. Inside reporting the outcomes as of and for the three and you can half a year finished Summer 29, 2025, the firm provides supplemental monetary steps on the a completely tax-comparable, tangible, or modified foundation. These types of low-GAAP economic steps try a supplement so you can GAAP, which is used to prepare the company’s monetary statements, and cannot meet the requirements in the separation otherwise alternatively to possess similar actions determined in accordance with GAAP. At the same time, the company’s non-GAAP financial procedures is almost certainly not much like low-GAAP monetary procedures of other programs.

Size of global financial world

Homebuyers and you can savers try digesting the news headlines that Lender of England try reducing the influential Bank Speed out of 4.75% to cuatro.5%, writes Kevin Pratt. Times bills are expected to go up because of the to 5% from April if the next price limit requires feeling. The new Chancellor, Rachel Reeves MP, will even submit the woman Spring season Statement – a budget in most however, identity – second Wednesday, that have traditional one to she is preparing deep cuts in public places investing, subsequent destabilising the new discount. In the uk, the new ‘wait-and-see’ means of one’s Lender’s nine-solid Economic Rules Committee, and this chosen 8-1 in rather have away from staying one speed slash to your ice, shows secret situations in the upcoming weeks. Employers are also warning that the raise on the Federal Insurance Benefits away from 6 April have a tendency to stymie progress from the restricting recruitment in the one avoid of your own level and you may leading to redundancies at the almost every other.

March: Policymakers Continue Weather Vision For the April Price Hikes

Companies are and alerting of wider speed expands whenever the boss national insurance efforts rise in April. The ability rate limit will even improve to your step one April, from the a surprise six.4%, taking a much deeper strike to household cash. Policymakers are also rebellious concerning the possibility of geopolitical issues in order to inflict economic wreck, with uncertainty clouding tranquility effort inside Ukraine and you will Gaza.

Solid inflationary headwinds are actually a regular feature of your worldwide economic environment. People in the newest MPC chosen overwhelmingly for the half-commission point improve that have eight ballots in the rather have, compared to you to definitely facing. The newest BoE and predicted one inflation you will remain at “very elevated membership” regarding the span of the following year.