Blogs

Create their U.S. notes for the PayPalLegal Disclaimer (opens inside popup)‡,Legal Disclaimer (reveals inside popup)39 account to transmit currency to help you family and friends from the You.S. See Irs.gov/SocialMedia observe the different social media devices the newest Internal revenue service uses to share the new information about tax alter, con alerts, efforts, things, and you may services. Don’t post the public shelter count (SSN) and other private information about social media sites. Always manage your own name while using the people social network website. To allege the brand new different, you must be able to prove that you be considered away from either the fresh around the world business arrangement supply otherwise You.S. tax rules. You need to know this article amount of the fresh worldwide organization agreement income tax different provision, if a person is available, and also the amount of the brand new Professional buy designating the company while the a major international company.

Document a state that have Plunge every month the unit try bare and we will make book costs before device is actually re-assist or even the visibility limitation might have been satisfied, any takes place earliest. Even though it is permissible underneath the rules, may possibly not getting a good idea to agree to play with a protection deposit while the past day’s lease. Through providing owners greatest visibility and you will self-reliance, you could potentially look after complete investment security and improve protection deposit visibility and you may recommendations. Because of the permitting citizens get more of the shelter deposit back, you’ll alter your protection deposit ratings, too.

You can not claim costs for a depending stated by your spouse. While you are hitched filing as you, include the mutual levels of earnings allocated to Ny out of the new independent Plan An areas accomplished by you as well as your companion to your Setting They-203, line step one, in the New york County amount column. Work months try weeks on which you used to be required to do common obligations of one’s employment. Any allotment for several days worked outside Ny State need to be depending the fresh efficiency away from functions and this, due to need (perhaps not comfort) of one’s workplace, obligate the newest worker in order to aside-of-county requirements in the provider of their employer. Including obligations are the ones which, by the the really nature can’t be did from the workplace’s office.

If you want to pre-shell out tax to your income claimed on the government Mode 1099-MISC or Form 1099-NEC, explore Setting 540-Parece, Projected Taxation for those. To avoid a defer on the processing of your own income tax return, enter the proper amounts on the internet 71 as a result of range 74. To work the degree of that it borrowing, utilize the worksheet for the Borrowing to possess Shared Child custody Head of Home in this line tips. For individuals who be eligible for the credit for Shared Custody Head of Home and the Borrowing from the bank to have Founded Parent, allege only 1.

The fresh property manager’s guide to leasing shelter deposits

If the Irs examines and you may transform their federal taxation come back, and also you owe a lot more taxation, report such alter for the FTB in this six months. Its not necessary to tell the new FTB if the changes do not increase your California income tax responsibility. If the transform from the new Internal revenue service trigger a refund due, you need to document a declare for reimburse within 2 yrs. Have fun with a revised Function 540 and you will Schedule X to make one change to the California taxation production in the past filed.

For example taxpayers would be to done PA-40 Plan Grams-L, Borrowing to possess Taxes Repaid from the PA Citizen Someone, Properties otherwise Trusts to many other Claims. PA-40 Schedule G-L need are a copy of one’s taxation come back filed that have another condition find more information . If you along with your spouse generated your projected payments as you, you will want to file a mutual tax get back. The design need to be finished in its totality, demonstrating the total level of repayments designed for the entire year and you may the level of the fresh payments becoming moved to the newest companion. This type will be provided for the new target revealed to the function before filing the brand new come back or a duplicate of one’s mode will likely be submitted having each other output when processing. It prevents control delays and you can communication from the agency.

Saying estimated tax payments:

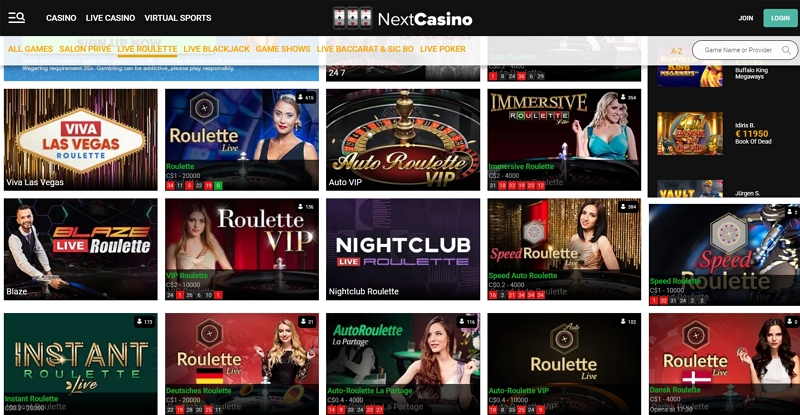

Here’s a listing of the new web based casinos United states no deposit incentive also provides as of Get. With a game title choices nearly as large as BetMGM, Borgata is just one of the finest casinos on the internet in america. The newest $20 no-deposit membership incentive merely deal a good 1x betting, meaning that the asked worth is all about $19.50 if you gamble slots with a high return to player. Stating which bonus is extremely important if you’d like to obtain the $2 hundred no deposit incentive. The newest password FINDER1500 will provide you with a great $twenty five no deposit incentive in just 1x betting requirements. Along with the high welcome render, the largest on-line casino in the us has a lot to provide in order to participants.

When to go back accommodations security deposit

- Generally, the newest Income tax Department cannot notify you that your particular reimburse features already been placed.

- If your defense deposit are addressed as the last book commission, a landlord won’t have usage of the new leasing protection put to cover damages because of the newest tenant.

- If your decedent has one or more beneficiary, the brand new decedent’s $20,one hundred thousand pension and annuity money exclusion need to be designated among the beneficiaries.

- For many who signed a rental to the property owner, the new property owner accounts for coming back the portion of the deposit.

- If we require their created confirmation and now we don’t found the criticism or matter on paper within 10 (10) business days, we may perhaps not borrowing from the bank your account.

- Contributions spent on the brand new Service away from Seafood and you can Animals would be familiar with establish a-sea otter fund in the service’s index programming system for increased analysis, reduction, and you may administration step.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6PMV5QKNHFOG7B7BAFWKMF6BL4.jpg)

I meet the requirements people who don’t fulfill their strengthening’s earnings or borrowing conditions. That have a leap guaranty, more residents have a tendency to be eligible for your functions and you also’ll know that the lease move are shielded. Be careful not to work on afoul away from discrimination legislation when demanding some other protection places for different clients. Roost’s platform, such as, allows roommate splits to have put payments and you can refunds as opposed to launching the brand new leaseholders from duty for the and all tool ruin.

The new Work 46 out of 2003 changes one pays focus on the overpayments to your team fees equivalent to the speed determined for underpayments minus dos per cent cannot connect with Article III of your Taxation Reform Password away from 1971. With Very early Pay day, the lending company can make particular lead deposits on the market one in order to two working days before we get the money from the new payor, which is normally your boss. Very early Pay check is not guaranteed, can vary between shell out attacks, and then we can get stop getting it at any time as opposed to improve see for you.

Desk dos-step one. Report on Origin Legislation to own Earnings from Nonresident Aliens

It can help for those who grabbed pictures before you gone while the proof the fresh condition of your local rental one which just gone in the. In case your property owner doesn’t give research, you might be in a position to file up against them inside small-claims judge. This guide explores all about defense deposits, your liberties for the security put refund, and you may option alternatives for securing the security deposit while you are economically confronted. On the average rent now being $1900 regarding the You.S. to own a two-bedroom flat, of several should expect to invest as much as anywhere near this much to your put too, putting some flow-in cost almost $4000(!) in addition to a lot more charge.

Have and you can Professionals

Fundamentally, he’s got smaller deposit standards than loads of its competition. This makes him or her much more accessible, but it addittionally caters to a preferred sort of total gamble. Of a lot players today want to installed more frequent places one are on the little top instead of a bigger put one to only goes periodically, which was the brand new liking for most professionals in past times. $5 minimum put casinos online is actually greatly popular throughout the world as these gambling enterprises render expert online game, nice campaigns and you can lower lowest put local casino bonuses, cellular being compatible and you will top percentage alternatives for short budget professionals. Consider PA Personal Taxation Publication – Net gain (Loss) Regarding the Process away from a business, Occupation or Farm.

Delight understand the relevant Wells Fargo membership contract otherwise debit and you can Automatic teller machine card terms and conditions to possess information about liability to own not authorized purchases. You can open a bank checking account on the web or perhaps in-individual in the a Wells Fargo branch. Alliant is amongst the finest credit unions available, particularly if you have to secure highest rates on the deals, checking, and you may licenses. The 3-day low-tidal licenses (open to nonresidents just) allows licensee to seafood the newest seas out of Maryland to have step 3 straight fishing days. When there is a legal need to save the new put, document the situation and supply a composed reason to the occupant in your state’s founded schedule.